Our Top Free Resource

This comprehensive estate planning kit helps you protect your family and establish your legacy. FREE!

Download My KitSolutions for Large Donations

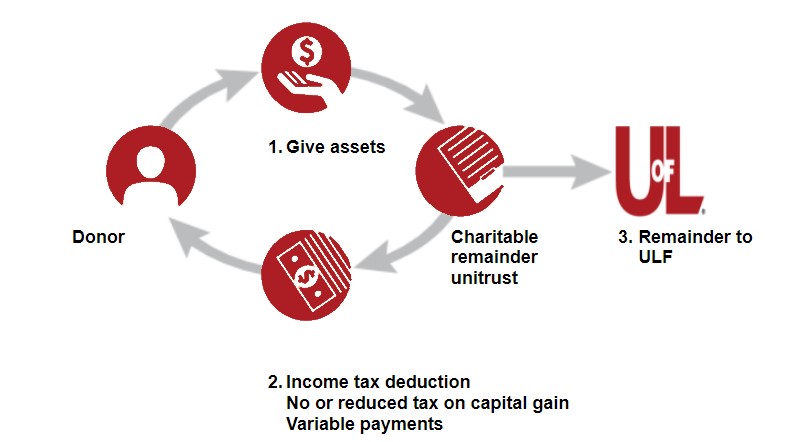

If you have built a sizable estate and also are looking for ways to receive reliable payments, consider a charitable remainder trust. This type of trust provides you or other named individuals income each year for life or a period not exceeding 20 years from assets you give to the trust you create. At the end of the trust term, the balance in the trust goes to the University of Louisville.

These types of gifts may offer you tax benefits and the option for income. There are two ways to receive payments and each has its own benefits:

The annuity trust pays you, each year, the same dollar amount you choose at the start. Your payments stay the same, regardless of fluctuations in trust investments.

The unitrust pays you, each year, a variable amount based on a fixed percentage of the fair market value of the trust assets. The amount of your payments is redetermined annually. If the value of the trust increases, so do your payments. If the value decreases, however, so will your payments.

You transfer cash, securities, or other property to a charitable remainder trust.

You receive an income tax deduction. If you give appreciated assets, you pay no capital gains tax on their transfer to the trust. During its term, the trust pays a percentage of its value each year to you or to anyone you name.

Submit a few details and see how a charitable remainder trust can benefit you.

This comprehensive estate planning kit helps you protect your family and establish your legacy. FREE!

Download My KitSee which type of charitable trust best fits your estate plan with the FREE guide Trusts: Choose From Two Ways to Donate.

This comprehensive estate planning kit helps you protect your family and establish your legacy. FREE!

Download My Kit